It can be said that the catering sector has been one of the most affected sectors in Germany recently as the restrictive policies were applied to deal with the Covid-19 pandemic. By applying drastic measures, the government has been doing a great job to slow down the progress of new infections in the community. This is a good sign for both society in general and the German economy in particular.

However, to ensure effective prevention of the epidemic in the long term, loosening restriction measures are being considered by the Government to help companies and business households to overcome the crisis and rebuild the economy, especially for the F&B businesses – those who are directly affected by the disease.

1. New tax policy for the F&B sector

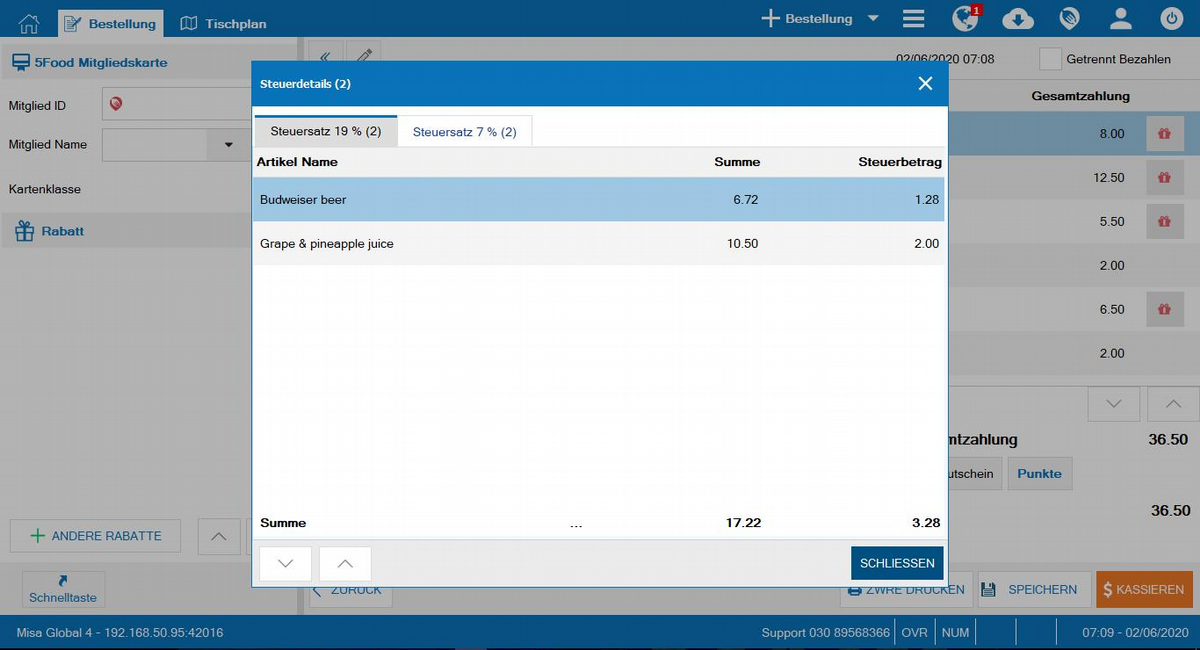

Restaurants and other restraint businesses have already re-opened in Germany, but under heavy restrictions to limit the number of customers and ensure a safe minimum distance. The important thing to do during this time is to ensure both operations and profitability are maintained. Besides, the German Ministry of Finance officially lowers the VAT for food from 19% to 7%. The new VAT will be officially applied on July 1, 2020, and continue for a year.

However, the VAT rate for drinks remains the same 19% as before (applies to both dine-in and takeaway).

2. How can we respond promptly to the new tax policy of The Ministry of Finance?

CUKCUK understands that in the first step of the changing tax rate process, you may make mistakes in quantifying ingredients, setting up the menu, and calculating the net profit due to food cost fluctuation. However, everything will be under control if your restaurants are using CUKCUK. There is a function integrated into the software that will help you proactively change the applicable tax rate. You can also adjust the tax rate on the software management interface.

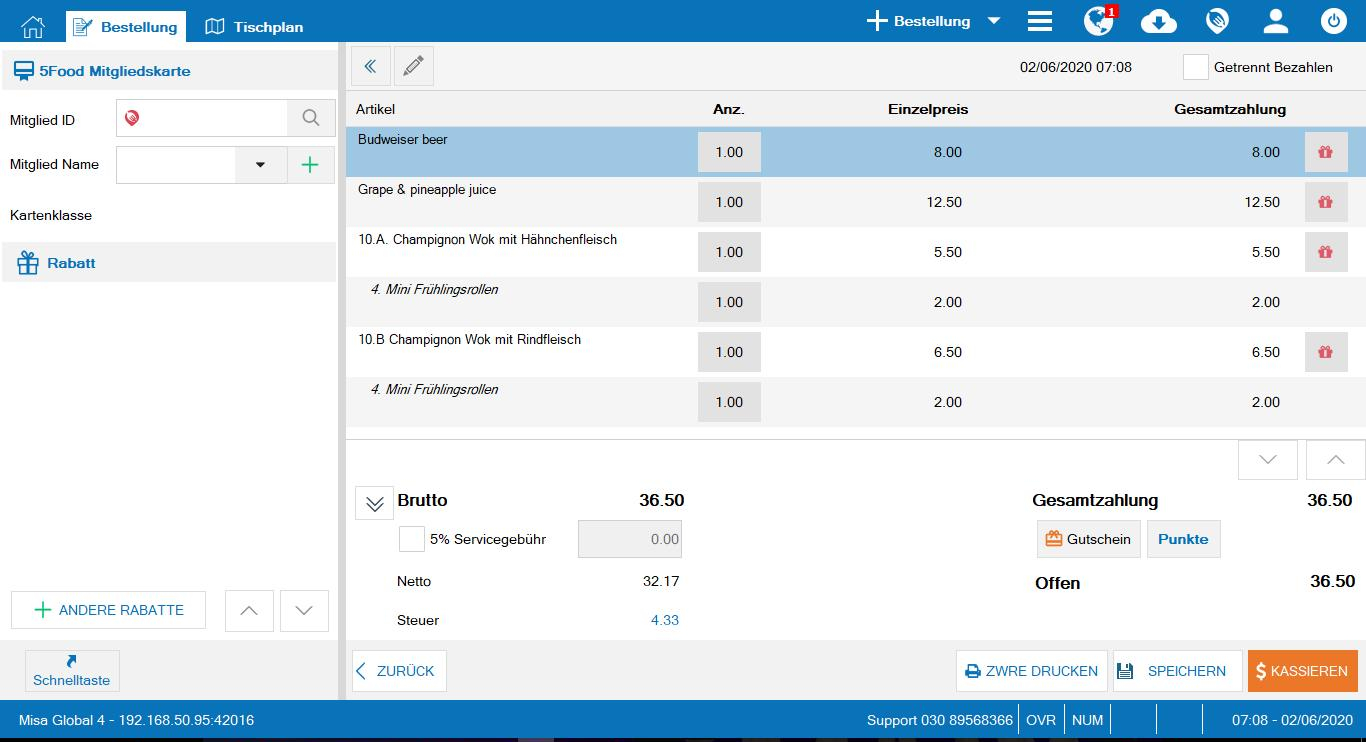

CUKCUK’s system will synchronize data from the menu to the sales report. Everything will be recorded with the new tax rate. The management process will remain easy regardless of the change.

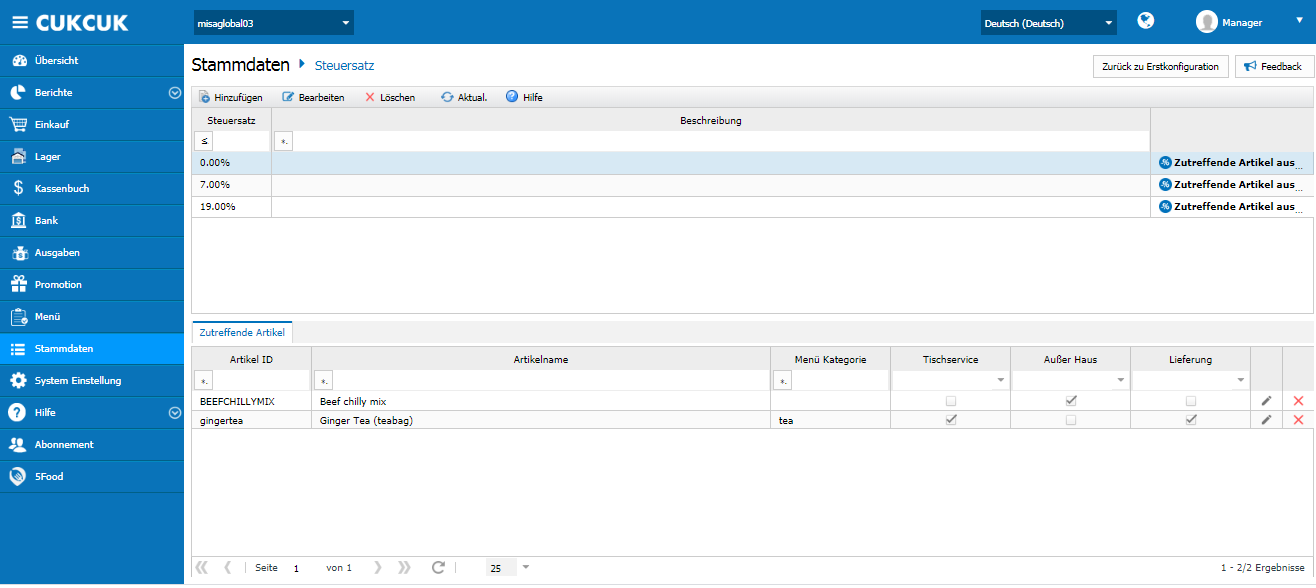

3. Instruction to change VAT on the software

First, open the manager overview browser on the system

- On the management page, in the System setup / Purchase / Sales section, click Edit.

- In the Service charge at the restaurant section, select Tax on the service charge.

- Click Save.

- When the cashier charges a customer, the service charge will be automatically taxed by the system.

Hopefully, with the implementation of new tax policy, the German F&B industry, especially restaurants, will take a leap to fully recover from a long hibernation. CUKCUK always sides with your restaurant to overcome this pandemic.